how much does illinois tax on paychecks

Federal tax rates like income tax Social Security 62 each for both employer and employee and. Switch to Illinois hourly calculator.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Amount taken out of an average biweekly paycheck.

. If you have not enrolled in direct deposit you can enroll through MyIllinoisState. The employer cost of payroll tax is 124. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4.

Also not city or county levies a local income tax. Amount taken out of an average biweekly paycheck. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Overtime Pay in Illinois. Illinois labor laws require you to pay hourly employees for any hours worked over a 40-hour workweek. Additional Medicare Tax.

For example an employee with gross wages of 1500 biweekly and a 500 Section 125 deduction has 1000 in gross taxable wages 1500 500. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. If youre married filing jointly youll see the 09 percent taken out of your paycheck if you earn 250000 or more.

The new office location will be open at the following address on Monday June 27 2022. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed.

Figure out your filing status. Also deducted from your paychecks are any pre-tax retirement contributions you make. Thompson Center 100 West Randolph Chicago Illinois 60601.

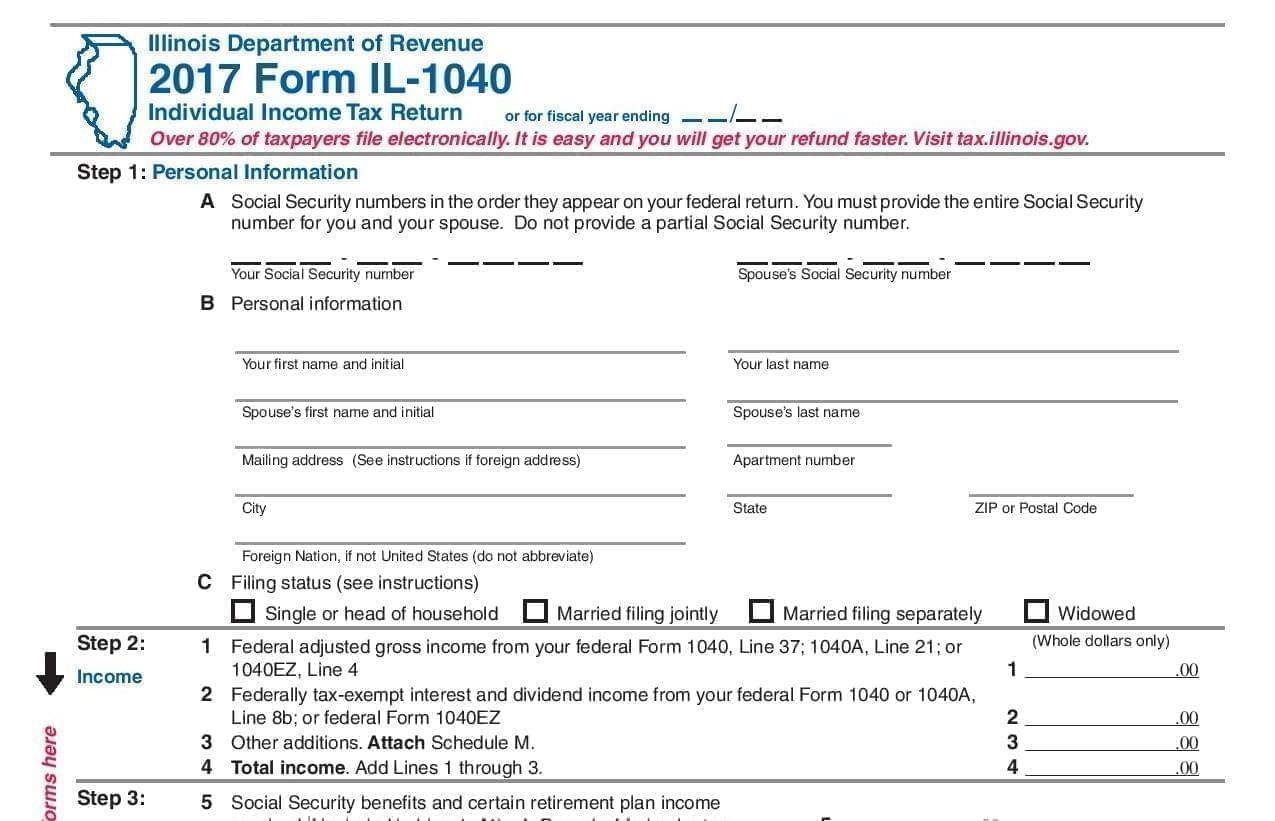

Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. How Your Illinois Paycheck Works. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator.

Median household income in Illinois. When you were a teenager you may have had a part-time job that paid you under the table. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

The average tax rate for those in the lowest income tax bracket is 106 percent higher than each group between 10000 and. Keep in mind that some pre-tax deductions eg Section 125 plans can lower the gross taxable wages and impact how much you contribute per employee paycheck. In addition to state and county tax the City of Chicago has a 125 sales tax.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. The average tax rate for taxpayers who earn over 1000000 is 331 percent. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance Division at 1 800 732-8866 or 1 217 782-3336.

There also may be a documentary fee of 166 dollars at some dealerships. Census Bureau Number of cities that have local income taxes. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

In Illinois the Supplemental wages and bonuses are charged at the same state income tax rate. There is also between a 025 and 075 when it comes to county tax. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

These are contributions that you make before any taxes are withheld from your paycheck. This applies to workers over the age of 18. The Waiver Request must be completed and submitted back to the Department.

You may pay up to 050 less an hour for your new hires in their first 90 days of employment. Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. Enroll in direct deposit so your funds will be in your account on payday.

This closure is in preparation for our move out of our Chicago office at the James R. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing status or wages earned at another job. Illinois Paycheck Quick Facts.

8 New or Improved Tax Credits and Breaks for Your 2020 Return. For those who make between 10000 and 20000 the average total tax rate is 04 percent. State Employees Retirement System.

On Friday June 24 the Chicago location of Illinois Department of Revenue will close to the public at 1200 pm. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

If would like to change your current withholding please complete a new W-4P and send it to the contact information below. Helpful Paycheck Calculator Info. Total income taxes paid.

Illinois income tax rate. Employees who desire to update their direct deposit via Employee Self Service must be on an Illinois State Network or using a VPN which can be obtained via the IT Helpdesk at 309438-4357. If youre a new employer your rate is 353.

In that case your paycheck whether. Newly registered businesses must register with IDES within 30 days of starting up. Total income taxes paid.

Illinois tax year starts from July 01 the year before to June 30 the current year. The wage base is 12960 for 2021 and rates range from 0725 to 7625. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Want To Learn How To Organize Your Budget But Not Sure Where To Start I Ll Share 60 Simple Budget Categories To Hel Budget Categories Budgeting Simple Budget

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Mid 2017 State Income Tax Rate Hike Throws Off Taxpayers Illinois Public Media News Illinois Public Media

2021 Federal Payroll Tax Rates Abacus Payroll

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Policy Basics Tax Exemptions Deductions And Credits Center On Budget And Policy Priorities

How Do State And Local Sales Taxes Work Tax Policy Center

Illinois Paycheck Calculator Smartasset

Raymond J Busch Ltd Now Serving You From Two Locations 13011 S 104th Ave Suite 200 Small Business Accounting Services Business Accounting Information

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 Federal Payroll Tax Rates Abacus Payroll

Best Representation Descriptions Does Walmart Cash Cashiers Checks Related Searches Auto Insurance Claim C Credit Card Design Money Template Payroll Template

Different Types Of Payroll Deductions Gusto

Where Your Tax Dollar Was Spent In 2018

Fillable Form 8822 B Change Of Address For Business Change Of Address Form Internal Revenue Service

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Utility Southern Cal Ed Utility Bill Edison Bill Template

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center